Nvidia has broken through another barrier. Valuation too high? "Some of the flywheels may collapse."

" Nvidia reaching $5 trillion in market capitalization is more than a milestone; it's a statement because Nvidia has gone from chipmaker to industry leader," said Matt Britzman, senior equity analyst at Hargreaves Lansdown, who owns shares in the company. " The market still underestimates the scale of the opportunity , and Nvidia remains one of the best ways to realize the potential of artificial intelligence," he added.

Shares of the Santa Clara, California-based company rose 4.6% after a series of recent announcements that solidified its dominance in the artificial intelligence race.

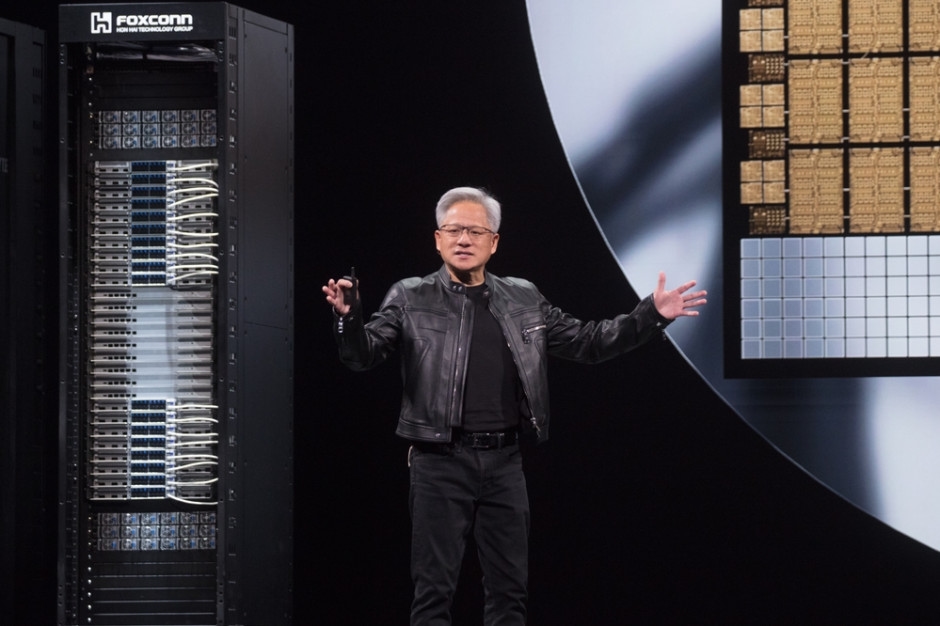

Nvidia Rally After Series of Positive NewsOn Tuesday, company CEO Jensen Huang announced orders for AI chips worth $500 billion and announced the construction of seven supercomputers for the U.S. government.

President Donald Trump is scheduled to speak with Chinese President Xi Jinping on Thursday about Nvidia's Blackwell chip . The sale of this advanced chip has been a key point of contention between the two sides due to export controls in Washington.

At current prices, CEO Huang's stake in Nvidia would be worth about $179.2 billion . He is the eighth-richest person in the world, according to Forbes' billionaires list.

Born in Taiwan and raised in the United States since the age of nine, Huang has led Nvidia since its founding in 1993. Under his leadership, the company's H100 and Blackwell processors became the engines behind multilingual models, powering tools like ChatGPT and Elon Musk's xAI.

Are Big Tech Valuations Too High? "They're Funding Each Other"While Nvidia remains the clear leader in the AI market race, Big Tech rivals like Apple and Microsoft have also surpassed $4 trillion in market value in recent months .

Analysts say the increase reflects investor confidence in the continued growth of AI spending, though some warn valuations could be high .

"The current expansion of artificial intelligence relies on a few dominant players funding each other. As investors start demanding cash flow returns instead of announcing new capacity, some of these flywheels could collapse," said Matthew Tuttle, president of Tuttle Capital Management.

wnp.pl